- Get link

- Other Apps

- Get link

- Other Apps

The concept of cash laundering is very important to be understood for these working in the financial sector. It is a course of by which dirty cash is converted into clean cash. The sources of the cash in precise are criminal and the cash is invested in a manner that makes it look like clean cash and conceal the identity of the legal part of the money earned.

While executing the monetary transactions and establishing relationship with the new customers or sustaining present clients the responsibility of adopting satisfactory measures lie on every one who is a part of the group. The identification of such component in the beginning is simple to take care of as a substitute realizing and encountering such situations afterward within the transaction stage. The central bank in any country offers complete guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously present sufficient security to the banks to deter such situations.

Authorities plan to limit cash deposits of dollars at bank counters as a measure against money laundering. Money laundering the process by which criminals attempt to conceal the illicit origin and ownership of the proceeds of their unlawful activities.

Understanding Money Laundering European Institute Of Management And Finance

These instruments are then given to.

Give the meaning of money laundering. Along with some other aspects of underground economic activity rough estimates have been. This technique involves the use of many individuals thesmurfs who exchange illicit funds in smaller less conspicuous amounts for highly liquid items such as traveller cheques bank drafts or deposited directly into savings accounts. The sale of illegal narcotics accounts for much of this money.

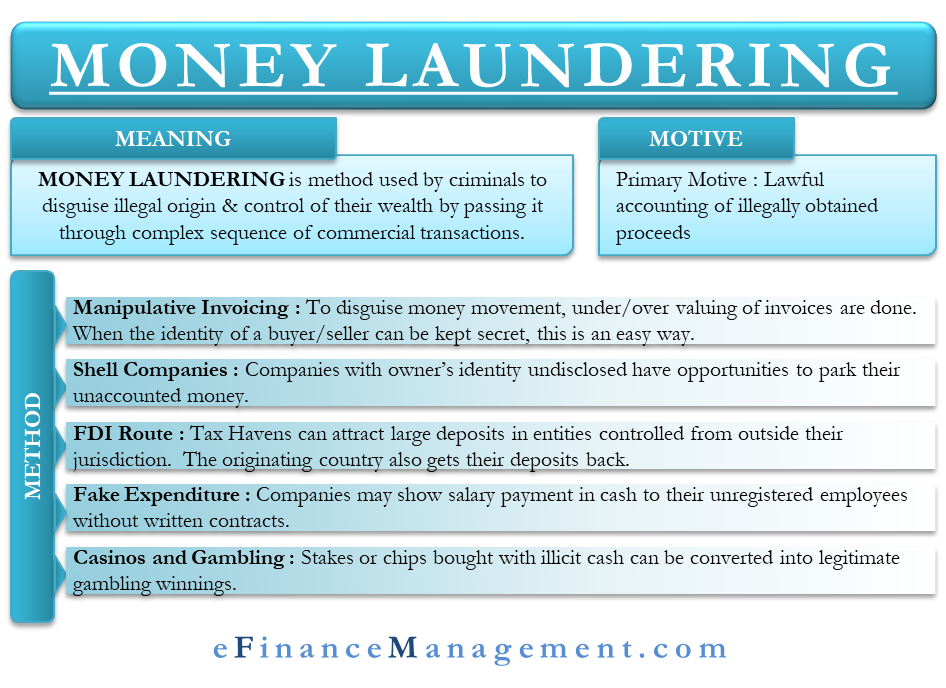

By its very nature money laundering is an illegal activity carried out by criminals which occurs outside of the normal range of economic and financial statistics. By means of money laundering criminals attempt to transform the proceeds from their crimes into funds of an apparently legal origin. Today money laundering is defined as any process that cleans illegally obtained funds of their dirty criminal origins allowing them to be used within the legal economy That definition.

Laundering allows criminals to transform illegally obtained gain into seemingly legitimate funds. The source of international consensus around the problem is considered. To wash dry and iron clothes sheets etc.

Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. Money laundering lets them do that by making it look like the money they have is from a legal source. First the illegal activity that garners the money places it in the launderers hands.

If you need to look up money laundering in the dictionary before setting your plan in motion youre not off to a good start. A Textbook Money Laundering Example. In the UK money laundering is a very real problem its thought that British financial institutions spend around 5 billion every year fighting financial crime.

The multilateral response including the pressure placed on the Philippines as. The purpose of this paper is to examine money laundering generally and the response of one jurisdiction the Philippines to international pressure for antimoney laundering measures Money laundering is examined and described. It is a worldwide problem with approximately 300 billion going through the process annually in the United States.

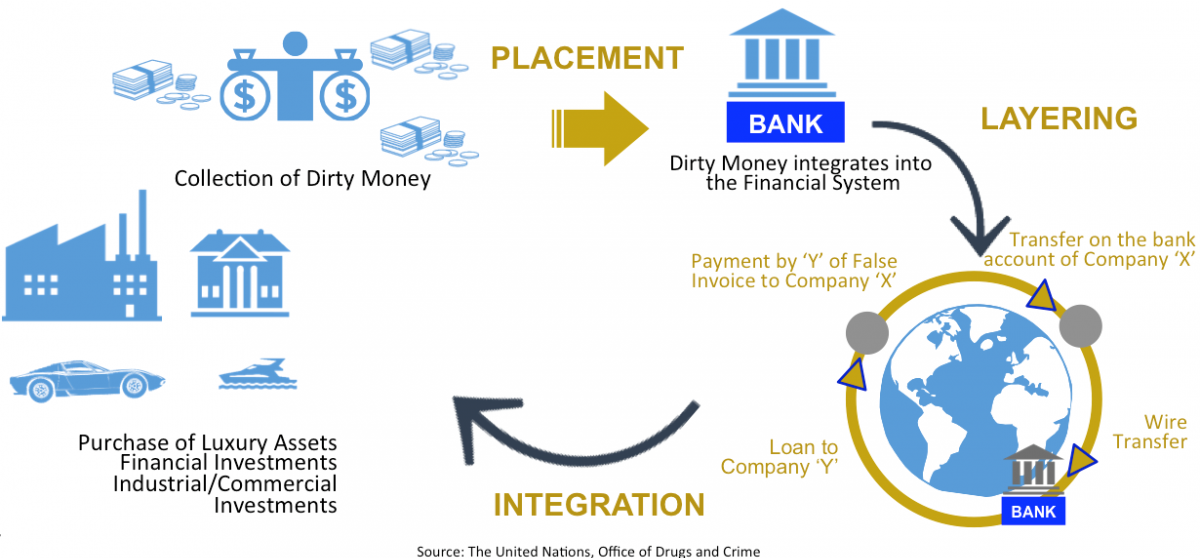

But Office Space creator Mike Judges farcical setup does underscore an important point. The money laundering process can be broken down into three stages. Present participle of launder 2.

The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source. Conceptually money laundering is pretty easy to understand. Money laundering refers to a financial transaction scheme that aims to conceal the identity source and destination of illicitly-obtained money.

The action of moving money which has been earned illegally through banks and other business to make it seem to have been earned legally. Layering Crimes that generate significant financial proceeds such as theft extortion drug trafficking and human trafficking almost always require a money laundering component so that criminals can avoid detection by authorities and use the illegal money that. Money laundering is the process by which large amount of illegally obtained money from drug trafficking terrorist activity or other serious crimes is given.

The Shady Pizza Parlor. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to. Money Laundering meaning in law Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct.

Money Laundering Ring Around The White Collar

Understanding Money Laundering European Institute Of Management And Finance

Financial Action Task Force On Money Laundering Fatf Fincen Gov

Anti Money Laundering Overview Process And History

What Is Money Laundering Amlc Eu

Money Laundering Define Motive Methods Danger Magnitude Control

Corruption And Money Laundering The Nexus Way Forward

What Is Anti Money Laundering Quora

What Is Money Laundering And How Is It Done

What Is Money Laundering And How Is It Done

Anti Money Laundering Fuzzy Logix

Money Laundering Overview How It Works Example

The world of laws can seem to be a bowl of alphabet soup at instances. US cash laundering regulations are no exception. We now have compiled a list of the highest ten money laundering acronyms and their definitions. TMP Danger is consulting agency focused on protecting monetary services by lowering threat, fraud and losses. We've massive bank expertise in operational and regulatory threat. We now have a robust background in program administration, regulatory and operational threat as well as Lean Six Sigma and Enterprise Course of Outsourcing.

Thus cash laundering brings many adverse penalties to the organization because of the dangers it presents. It will increase the probability of major risks and the chance price of the bank and finally causes the financial institution to face losses.

Comments

Post a Comment